Barclays Mortgages

Simplifying the mortgage journey, providing clarity on stages and progress for an accessible experience.

Objective

Users face a lengthy and confusing process when applying for a new mortgage or going through a renewal, often unaware of the number of stages involved as well as where they are in the process.

Hypothesis

To streamline the application process for a mortgage and provide a clear understanding of where customers are in their journey.

Process

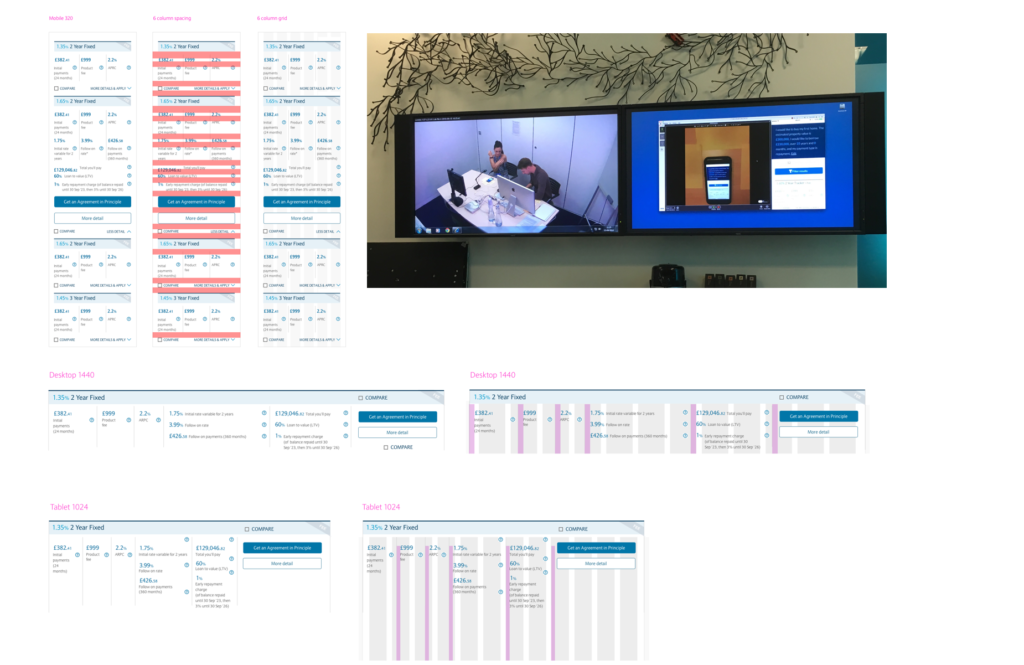

Tasks performed included creating user journeys, process maps, wireframes, and clickable prototypes for user testing. Smaller iterations also involved the redesign of widgets.

Metrics

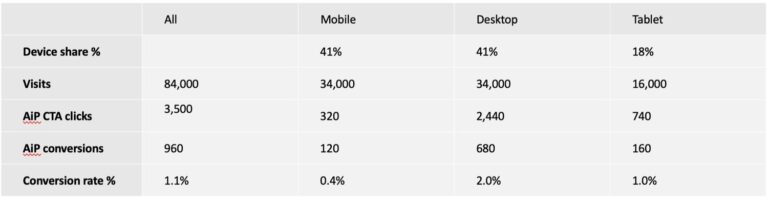

Analytics showed that a high number of users did not fully understand what was involved in the mortgage application process. From all devices including mobile, tablet & desktop 4.2% clicked through, but only 1.1% successfully completed an application.

30 Day snapshot

Artefacts:

- Experience map

- Mortgage lifecycle

- Sketching and wireframing

- Prototyping and testing

Journey optimisation

Analysing every screen in the journey helped to understand how users interacted with the product, helping identify pain points, areas of friction, and opportunities for improvement. This was also important for branding as it ensured that every screen felt like it belonged to the same product and that the user was not confused by sudden changes in design or functionality.

Output

- Gathering existing knowledge from clients and stakeholders and to prioritising and group findings

- Overlaying business needs and opportunities

- Having a visual point of reference and build agreement amongst the project team

Experience map

To gain a clearer understanding of a user’s mindset when applying for a mortgage several experience maps were created. These were valuable tools to gain empathy, identify opportunities, collaborate with cross-functional teams, align around user needs, and evaluate the success of the product. The main areas covered were ‘triggers and early research’ and ‘compare and explore’.

Learnings

To understand the stages customers go through when looking for mortgages, and to

gain an understanding of interaction types, be that a bank visit or a mobile search.

Lifecycle and stages of the mortgage application

Dependencies on customers to provide official documentation ranging from identity checks to proof of earnings, and then illustrating each step involving third parties including solicitors, estate agents, property surveyors, and various bank representatives.

Digital timeline idea:

- Helping customers understand where they were in the application and how many steps they still had to complete

- Provision of a visual document repository, so customers didn’t have to keep resubmitting the same documents

- Assisting via live chat for any queries

- Offering a selection of videos for further assistance

Sketching and wireframing

As an additional step, a questionnaire was presented to customers in branch. The key point was that first-time buyers were not fully aware of the detailed steps it took to complete a mortgage, only 24% were familiar with the process of the steps post-AiP (Agreement in Principle).

Prototypes and testing

Addressing customer concerns and feedback

- Not registered to vote. Lenders needed to confirm who they were along with their address

- Too much debt

- Too many credit applications

- Affordability

- Whether they were self-employed

- Having an insufficient deposit

- Poor credit history

Ongoing Considerations:

- Local knowledge/experience. Where is the lender located? Is the lender in the community? If so, that means, they will know your market and may have experience and connections with local people, such as real estate professionals and appraisers who can make the process easier.

- Local servicing. Will the lender maintain servicing of the loan or will they sell it on the secondary market.

- Honest rates and fees. Not all mortgage lenders are alike when it comes to pricing. When comparing lenders, it is necessary to review fees and rates closely to ensure that there are no surprises.

- Integrity. It’s important to choose a lender that will help find the loan that’s right for the customer’s budget, and not try to sell them a mortgage that’s more than they can comfortably afford

Wrap up and conclusion

Once new features were launched there was a positive uplift of 12.8% increase in AiP (Agreement in principle) applications with total numbers of completions increasing. These results were monitored and further improvements that could be delivered, included:

- Mortgage completion reminders and new mortgage deals suggested

- Visual overpayments calculators

- Interest rates change planning tools