HSBC - Kinetic

HSBC Business Kinetic is a digital banking platform offered by HSBC that is designed for small and medium-sized enterprises. It is aimed at helping SMEs to manage their finances more efficiently and effectively, with features such as 24/7 online access, real-time account updates, and the ability to track spending and manage cash flow.

The HSBC Kinetic App hasexcellent reviews on the Apple store with 4.8/5 over 7.2k ratings and has won various awards

Objective

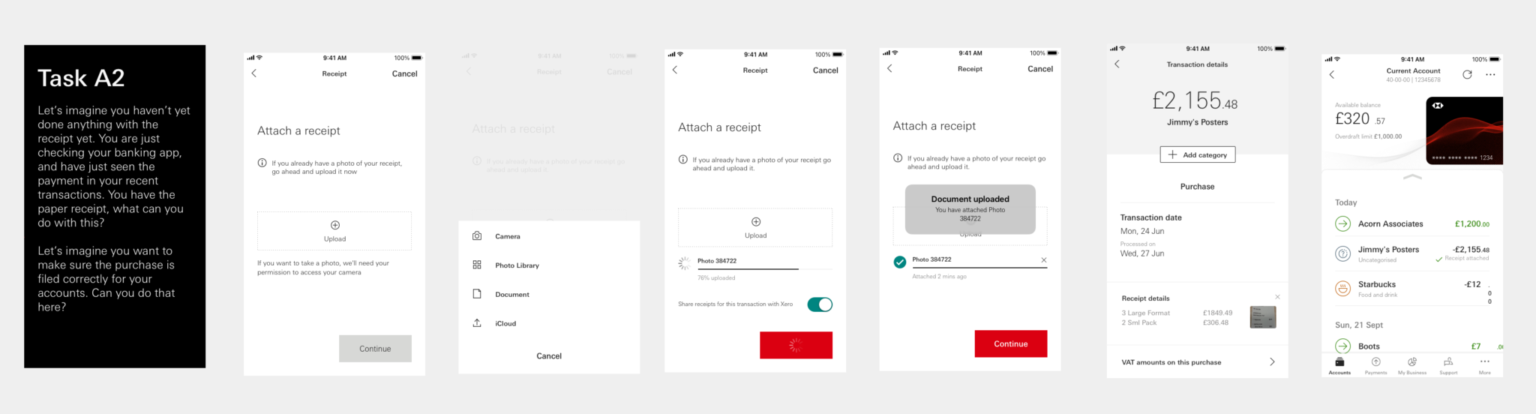

The objective was to simplify the task of logging and storing hard copy receipts and to enable the display of receipt data within transaction details.

Receipt processing. Two different methods of dealing with receipts were observed:

- Digital route: Those who were more digitally savvy used accounting software, such as Xero and Quickbooks, and entered receipts in a digital workflow e.g. by taking photos and using a companion app to upload the receipt images, or emailing them to accountancy software.

- Physical route:Those who kept physical receipts and provided these to accountants, sometimes along with spreadsheets (some manually compiled, some cut and pasted/exported from bank statements)

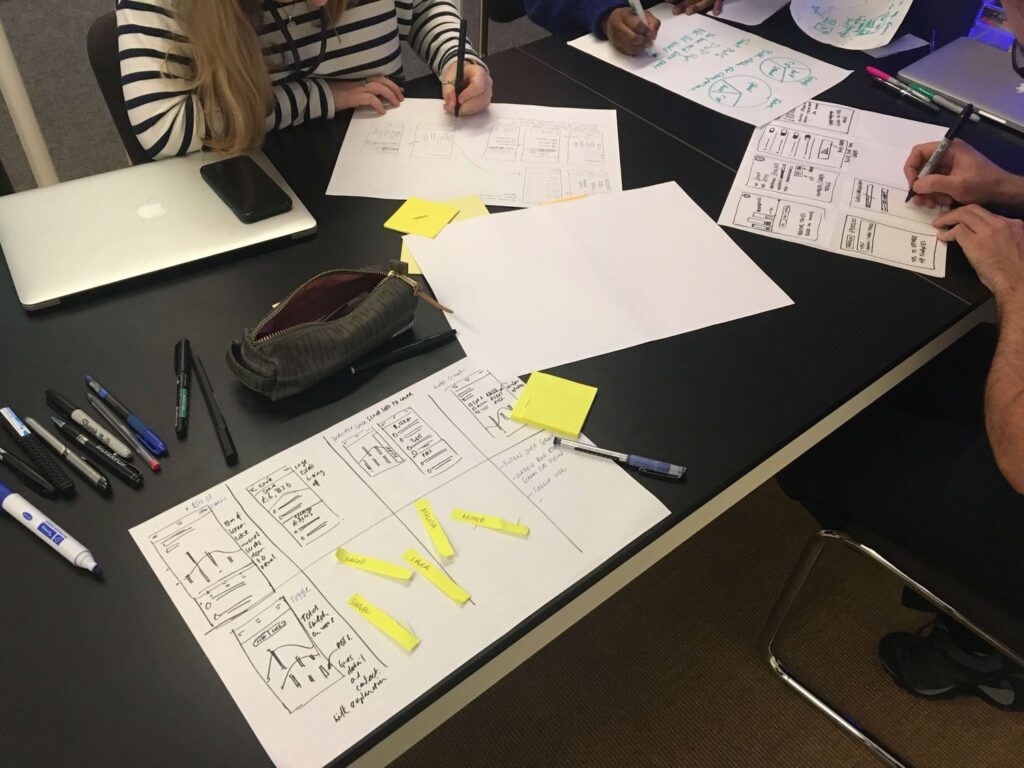

Design workshop

Crazy 8’s is a core Design Sprint method. It is a fast sketching exercise that challenges people to sketch eight distinct ideas in eight minutes. The goal is to push beyond your first idea, frequently the least innovative, and to generate a wide variety of solutions to your challenge.

Test prototype

Once a vote had been taken on the best solution from the Crazy 8’s session, a clickable prototype was developed to test how users would interact with the feature. During this process, the team of Engineers, Product Owners, Stakeholders, and BAs observed and listened to the feedback provided by users.

User feedback

- Overall, the ease of uploading a visual receipt was understood and appreciated by user

- Some users questioned how this would be entered with a pre-digitised receipt

- Many remarked that the additional history on the transaction was a useful feature

Considerations

- Unclear if it was a requirement by HMRC to keep the physical receipt

- Some users questioned how this would be entered with a pre-digitised receipt

- Additional history on the transaction was a useful feature

Recommendations

- Provide best practice guidance as to whether users should retain the physical receipts, and if so how long for. Ensure this guidance covers those without integrated accountancy software (Xero etc).

- Provide guidance on taking photos, and what the minimum legible criteria is. Address questions such as: Is it ok if some of it is not legible if the totals are still shown? Do you need the date visible? What if it is very long e.g. wholesale supermarket till receipt and so the text is very small on a photo?

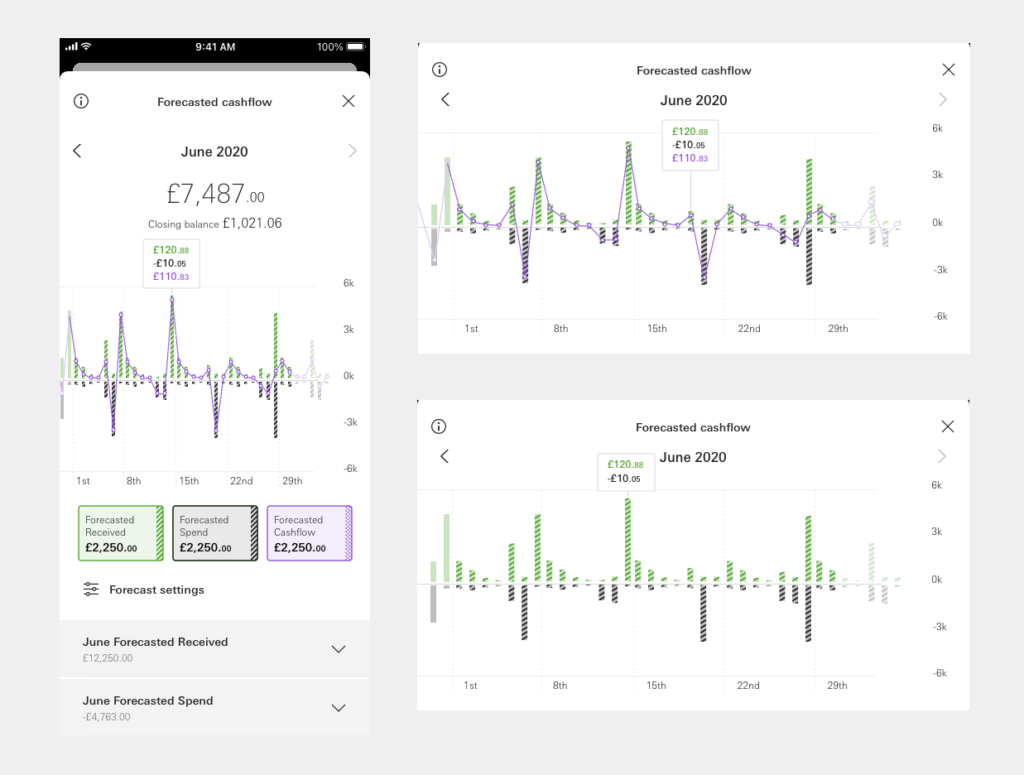

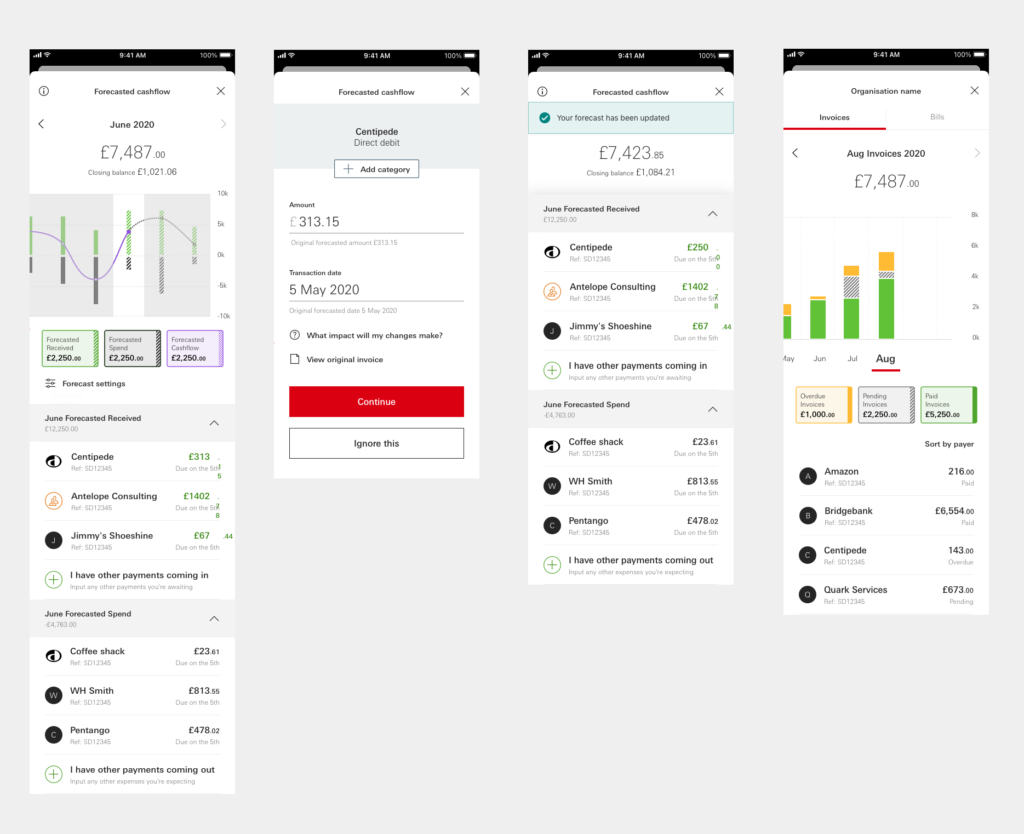

I can’t see the detail on the graph

Improvement – New graph and updates based on iOS13

Is the key tappable?

Improvement – Accessible and more tactile toggles

I know I have a payments coming in, which will influence my cashflow

Improvement – Invoices input methods

Seeing cashflow is good but far too small on my phone

Improvement – Landscape views to encourage deeper investigation

I find it difficult to spot regular incoming payments

Improvement – Clickable graph items and more data points