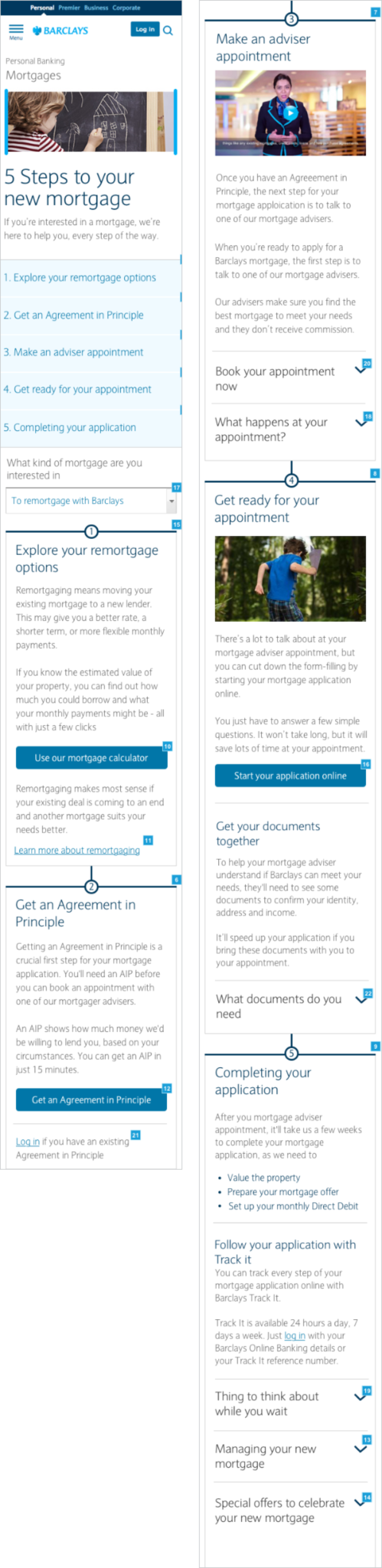

A thorough analysis of every screen in the journey provided valuable insights into user interactions, revealing pain points, friction areas, and opportunities for improvement. This process also played a key role in maintaining consistent branding, ensuring each screen felt cohesive and preventing user confusion caused by abrupt design or functionality changes.

Barclays Mortgages

Simplifying the mortgage journey, providing clarity on stages and progress for an accessible experience.

Objective

Users struggle with a complex and lengthy mortgage application process when applying for a new mortgage or going through a renewal, often unaware of the number of stages involved as well as where they are in the process.

Hypothesis

Streamline the mortgage application process to provide clarity on progress at each stage

Process

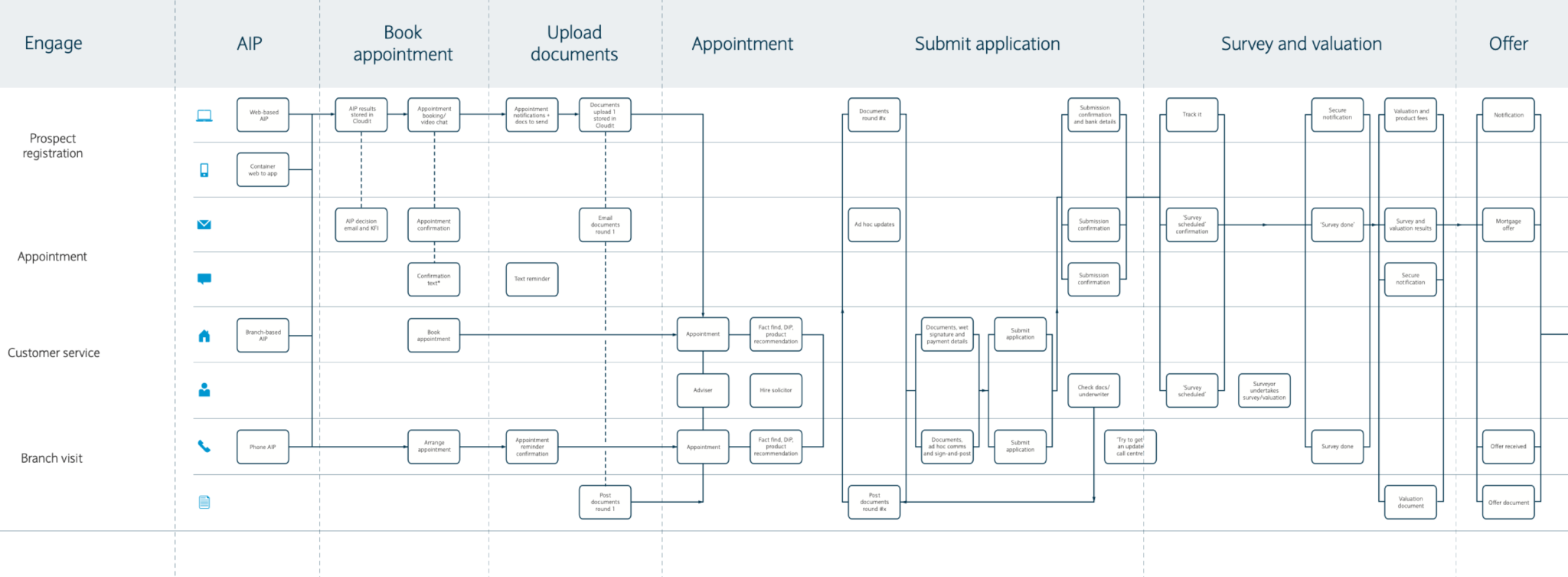

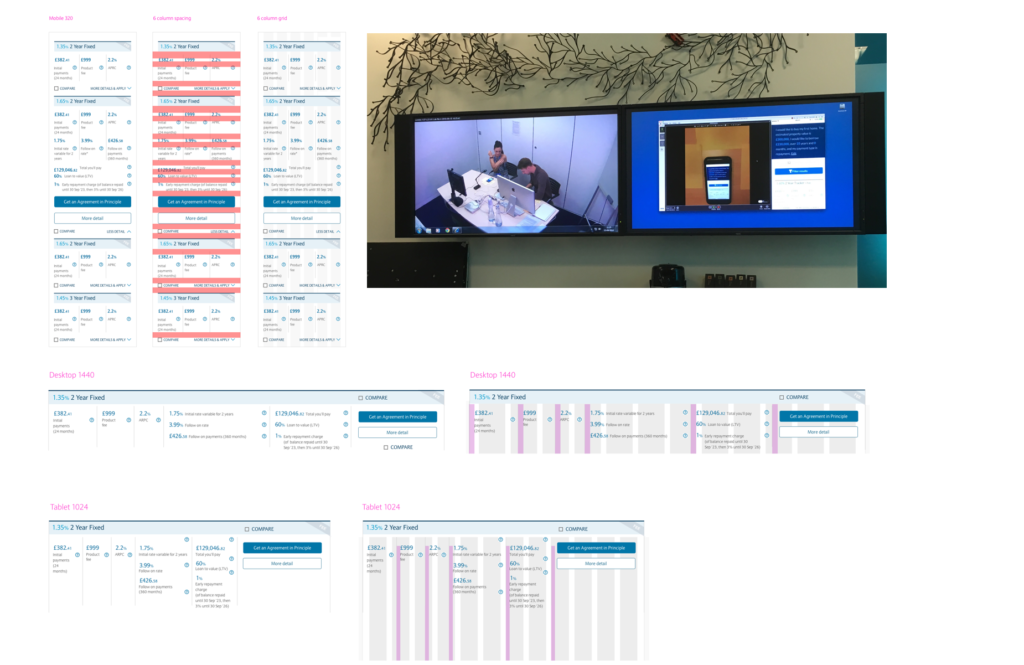

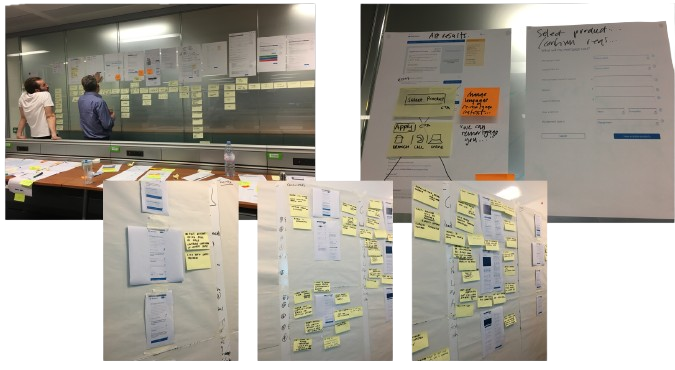

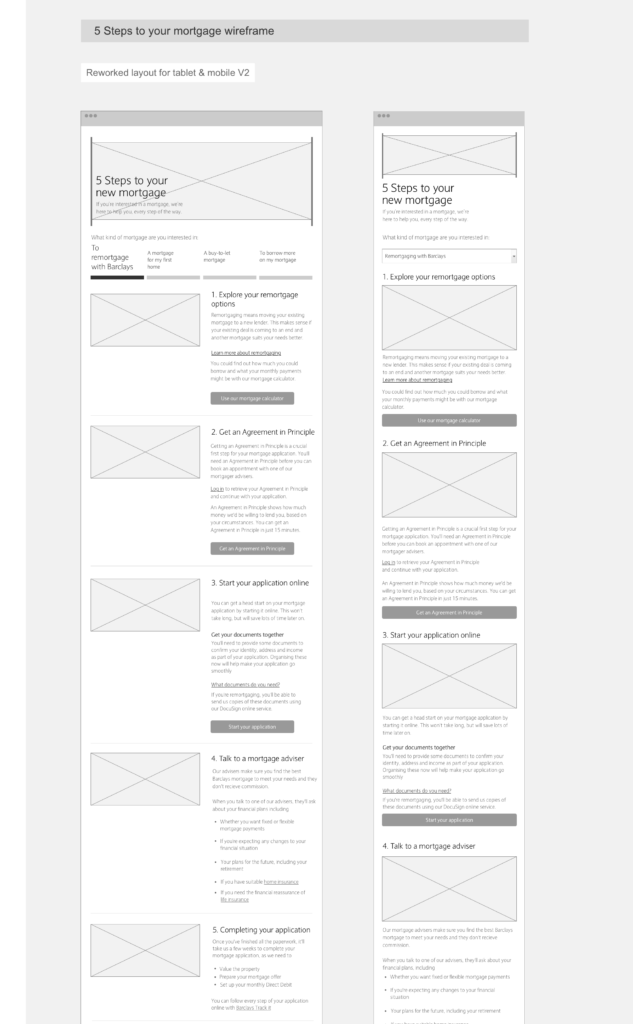

Tasks performed included creating user journeys, process maps, wireframes, and clickable prototypes for user testing. Smaller iterations also involved the redesign of widgets.

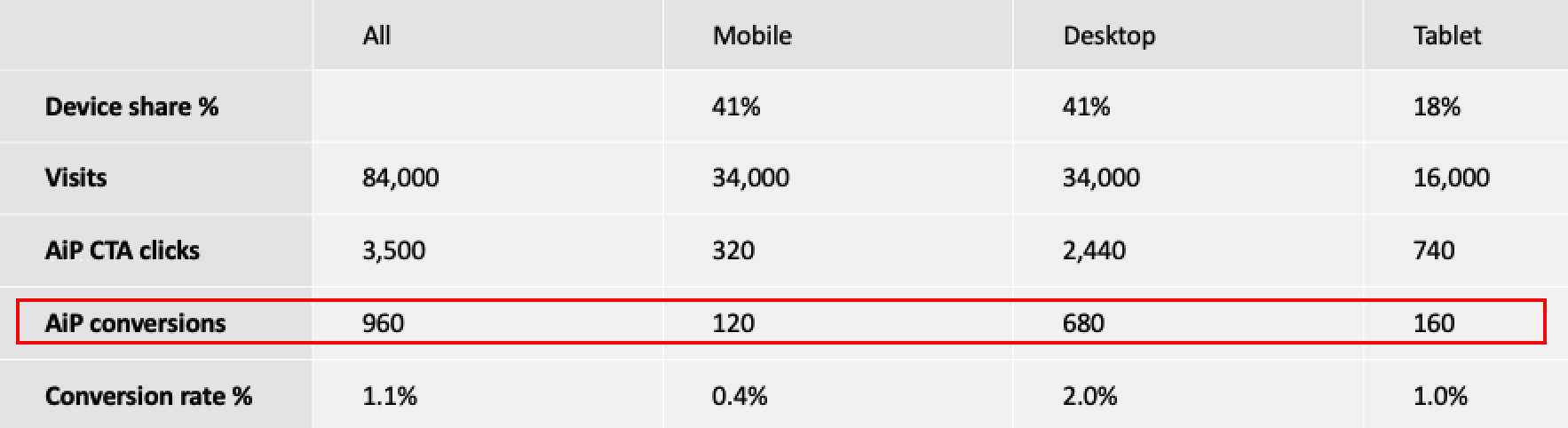

Metrics

Analytics and interviews showed that many users had difficulty understanding the mortgage application process. Across mobile, tablet, and desktop platforms, only 4.2% proceeded to the next step, and just 1.1% successfully completed an application.

4.2%

click through to the

application

Artefacts:

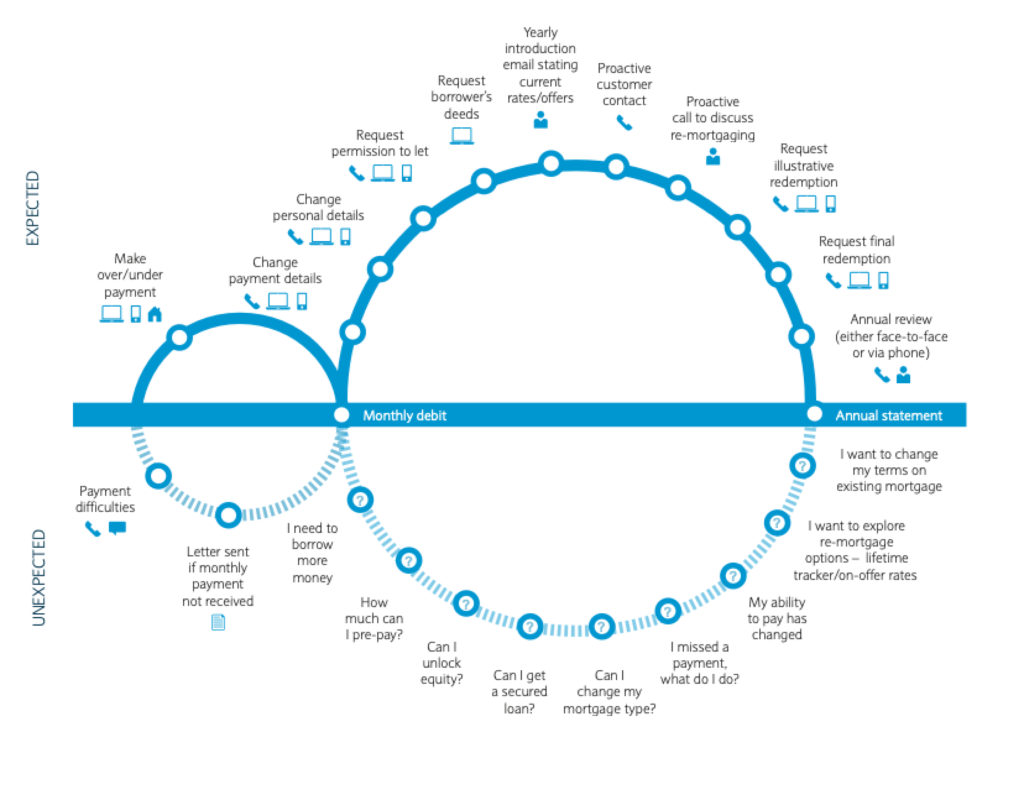

- Experience map

- Mortgage lifecycle

- Sketching and wireframing

- Prototyping and testing

30 Day snapshot

Optimising the journey

Steep learning curve

" Don’t understand product

types and terms

(eg, early repayment)"

Amba

Documentation

"Have I submitted the right documents?"

Isaac

Trust and relationships

"The bank does not treat me as a person."

Nga

Process

"When I contact the bank, the person I talk to can’t help."

Steph

Output

- Gather client and stakeholder insights, then prioritise key findings for action

- Align business objectives with opportunities to meet project goals

- Create visuals to ensure team clarity and alignment

Lifecycle and stages of the mortgage application

Customers must provide official documentation, such as identity checks and proof of earnings, often involving third parties like solicitors, estate agents, and surveyors. Failure to meet mortgage payments due to factors like job loss or rising interest rates can lead to financial strain, repossession, and credit issues.

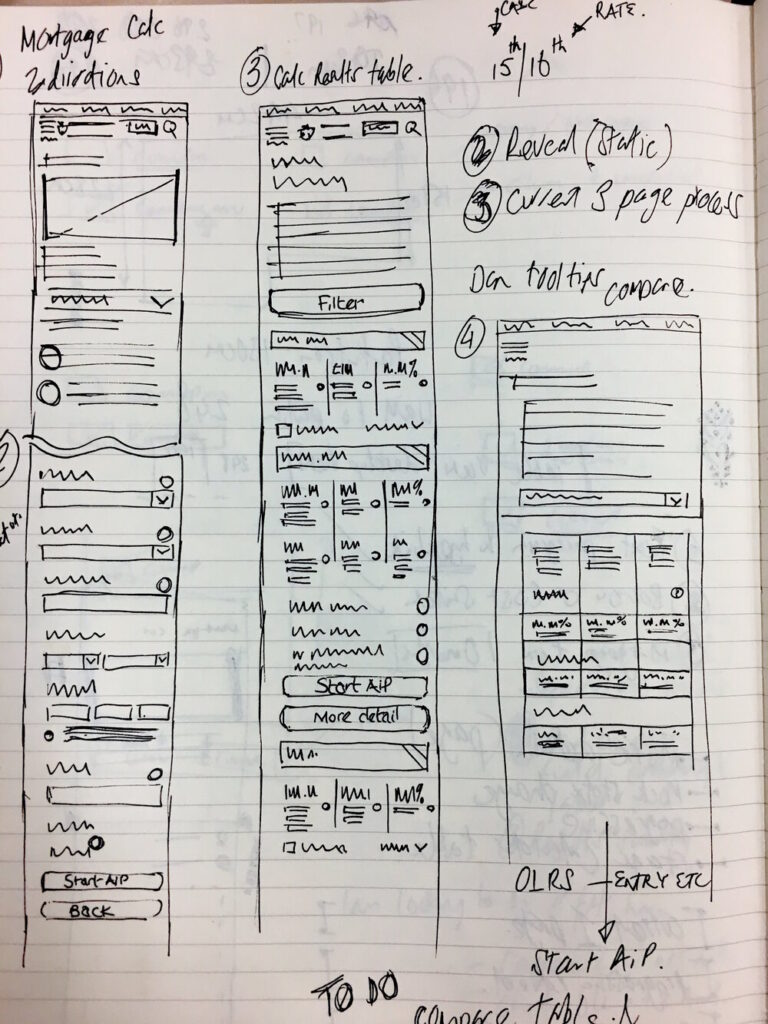

Sketching and wireframing

As an additional step, a questionnaire was presented to customers in branch. The key point was that first-time buyers were not fully aware of the detailed steps it took to complete a mortgage, only 24% were familiar with the process of the steps post-AiP (Agreement in Principle).

Prototypes and testing

Addressing customer concerns and feedback

- Identity & address Verification: Issues on voter and address details

- High Debt & Credit Activity: Excessive debt or recent credit applications

- Affordability Concerns: Difficulty meeting lenders' criteria

- Employment Status: Issues with self-employment or irregular income

- Credit and Deposit Issues: Low credit history or insufficient deposit

Solution: Digital timeline

- Clear progress markers displaying remaining steps and steps completed

- Providing a visual document repository to prevent resubmissions

- Providing real-time assistance through live chat for customer queries

- Providing a curated library of videos for additional support

- Helping customers navigate the application by highlighting progress

Ongoing Considerations:

- Local Knowledge & Experience: Is the lender based in your community? Local lenders often have a deeper understanding of the market, with connections to real estate professionals and appraisers that can simplify the process.

- Loan Servicing: Will the lender manage your loan locally, or will it be sold on the secondary market?

- Transparent Rates & Fees: Mortgage pricing varies between lenders. Carefully compare fees and rates to avoid unexpected costs.

- Integrity: Choose a lender committed to finding a mortgage that fits your budget, rather than pushing for a loan beyond your means.

Once new features were launched there was a positive uplift of 12.8% increase in AiP (Agreement in principle) applications with total numbers of completions increasing.

Wrap up and conclusion

- Mortgage completion reminders and new mortgage deals suggested

- Visual overpayments calculators

- Interest rates change planning tools